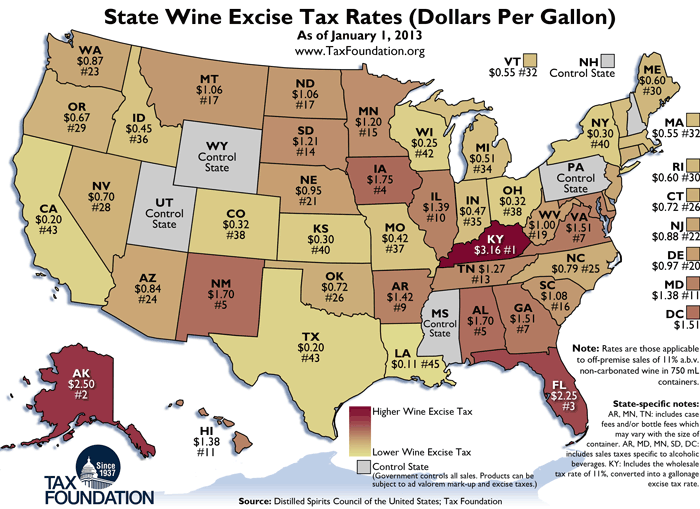

The Tax Foundation, a non-partisan, not-for-profit organization providing research and analysis on federal and state tax policy, issued a recent Weekly Map, which looked at state excise tax rates on wine. With a tax rate of $3.16 per gallon, Kentucky taxes wine more heavily than any other state, and Louisiana has the lowest rate at $0.11 per gallon. The Connecticut rate during the period of the report was $0.72 per gallon, and Rhode Island, $0.60 per gallon, placing their rankings as #30 and #26 respectively. Five states—Mississippi, New Hampshire, Pennsylvania, Utah, and Wyoming—are control states, wherein the government controls all sales, and products can be subject to ad valorem mark-up and excise taxes.

Map courtesy of Tax Foundation.

Map courtesy of Tax Foundation.